There are multiple potential pathways for EV batteries when they reach their end of life.

- The use of batteries in second life after reaching the end of life.

The goal to mitigate global climate change has resulted in strong policies aimed at reducing greenhouse gas emissions, decoupling economic growth from resource use, and more equitable distribution of costs and impacts related to energy.

This has been galvanized with large investments to support these objectives including through the EU Green Deal and the recovery plan for Europe, which includes large public investment to aid in the substitution of combustion vehicles for the electric vehicle.

With the rapid growth in battery markets, particularly the EV market, reductions in the cost and environmental impact of batteries can greatly improve their ability to help achieve energy and environmental goals. The use of batteries in second-life applications after reaching the end of life for their initial use is one way to reduce environmental impacts and the costs of storing energy.

“In 2025, 78% of the available scrap supply will be coming from manufacturing waste, while end-of-life batteries will account for 22%, according to new research by Benchmark Mineral Intelligence. It won’t be until the mid-to-late 2030s that the industry reaches an inflection point where volumes of used batteries available to recyclers start to surge, the consultancy predicts.”

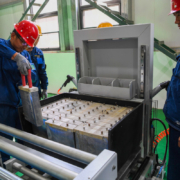

Uncertainties related to the state of the battery, the different ways and requirements for adapting the battery to a new application, and difficulties in analyzing the economic and environmental benefits, complicate the transition from the first life to the second life. The more common pathway nowadays is to build a refurbished battery from used modules to perform, such as stacking used EV battery packs.

- The first big wave of second life is likely to emerge.

The total vehicle stock of electric vehicles on the market is projected to increase through 2050. Each automotive manufacturer designs its own battery pack with a number of different models with a variety of characteristics, management, controls, and thermal management systems that will continue to increase. And this issue will affect the second-life analyses since the preferred second-life strategies depend on the specific characteristics of the electric vehicle battery.

“According to Bloomberg, most of the battery investment has been focused in China, which accounts for more than 80% of the world’s battery recycling capacity. It’s also where the first big wave of scrap is likely to emerge, because more EVs have been on the road for longer. There’s been a flood of plans for new recycling facilities across Europe and North America over the past year, but those plants will need to wait even longer for supply to start picking up.”

This is further complicated by variations of the degradation levels derived from the first-life use, which results in batteries reaching the end of life with different aging conditions. In addition, the battery state at end of life must be matched to the most suitable and/or profitable second-life end-use application considering duty cycle, size requirements, market size, and revenue potential.

In order to analyze and evaluate these uncertainties, a procedure is proposed to aid in the decision-making process regarding battery reuse. The battery assessment procedure is placed inside a solution of the battery life cycle.

This is to avoid incurring unnecessary expenses if a second-life solution is not recommended as an output of the analysis. To this end, the assessment is proposed in a way that it can be used by any battery manufacturer, EV manufacturer, distributor, specialist workshop, or vehicle owner.