Auto Giants Unite: The Inside Story of Honda and Nissan’s Merger Plan

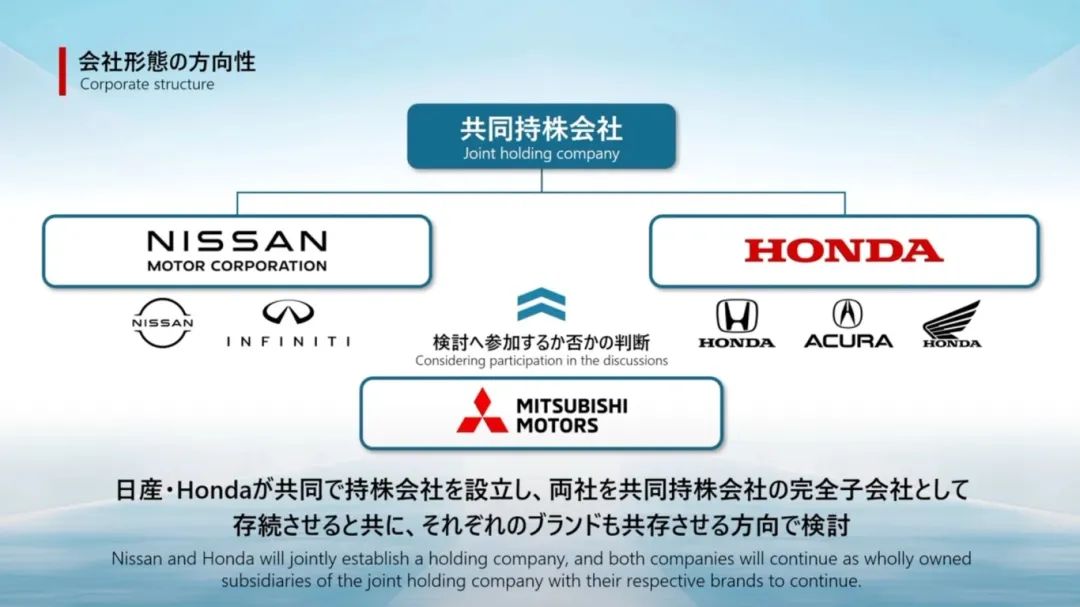

In the second half of 2023, Nissan Motor faced multiple challenges, including declining sales, overcapacity, and financial strain. After Renault sold some of its shares, Nissan urgently needed to find stable investors to strengthen its economic foundation. At the same time, with the rapid rise of China’s electric vehicle market, the market share of Japanese automakers was severely eroded. Honda Motor and Nissan Motor announced in August 2023 that they would explore cooperation, focusing on the joint development of electric vehicles and software technology. Honda CEO Toshiaki Mikihiko said, “The two companies will continue to operate as wholly-owned subsidiaries of the joint venture holding company and retain their respective brands. Cooperating with Honda does not mean we are giving up on our plan to improve Nissan’s situation.”

On December 17, 2024, the two parties further discussed merger matters, and on December 24, 2024, they announced the establishment of a new holding company. According to the agreement, Honda Motor will lead the holding company and nominate most directors, while Mitsubishi Motors may participate as a strategic partner. This means the global automotive industry will enter a new era of competition and reorganization. This cooperation is not only a survival strategy for the three companies to respond to market challenges, but it may also reshape the competitive landscape of the global automotive market. It’s a desperate move,” Carlos Ghosn said on Bloomberg Television. “It’s not a pragmatic deal because frankly, the synergies between the two companies are difficult to find.”

The Beginning and Progress of Joint Venture Negotiations

The incident originated at the end of 2023 when Honda Motor and Nissan Motor began exploring the possibility of cooperation due to difficulties in the Chinese market. The rise of Chinese electric and hybrid vehicle manufacturers, such as BYD, has severely weakened the competitiveness of Japanese cars in the world’s largest auto market. According to Macquarie Securities, the two companies face the dual pressure of overcapacity and declining market demand. Nissan’s production in China in 2023 was only 779,000 vehicles, a decrease of nearly 50% from its peak. Honda Motor announced the closure of some factories in China and adjusted to reduce production capacity by 20%.

To respond to market challenges, Honda Motor and Nissan Motor announced the expansion of electric vehicle and software technology cooperation at the beginning of 2024, and signed a memorandum of cooperation in June, with an initial plan to establish a new holding company. By December 24, the two parties officially reached an agreement, planning to list the new company in August 2026. Since Mitsubishi is a long-term partner of Nissan, it will also join this plan. Bloomberg pointed out, “If the deal is reached in 2025, the synergy of the merger between Honda and Nissan will take time to show. Nissan may be able to alleviate financial pressure, while Honda’s short-term benefits may be limited.”

Challenges and Opportunities in the Global Automotive Market

The background of this cooperation is the rapid changes in the global automotive market. The electric vehicle market is highly competitive, and emerging forces such as Tesla and BYD have risen rapidly, posing huge pressure on traditional automakers. According to data from the International Energy Agency (IEA), global electric vehicle sales exceeded 10.5 million vehicles in 2023, accounting for 14% of the total market. China has become the largest market, with nearly 60% of global sales coming from the country.

Uncertainty in the U.S. market has also forced Japanese automakers to seek cooperation. The upcoming Trump administration may restore tariff policies on imported cars, further affecting market competitiveness. The increasingly stringent environmental regulations in the European market are also a challenge for Nissan and Honda.

Strategic Advantages and Challenges of this Cooperation

Economies of Scale and Resource Integration: The merged scale will make it more competitive in terms of bargaining power and market influence. The combined market value of Honda Motor and Nissan Motor is approximately 8.1 trillion yen ($52.8 billion), which is still far lower than Toyota Motor’s 42.2 trillion yen ($275 billion), but it can compete with European and American competitors. In the first half of 2024, the global sales of the three companies were approximately 4 million vehicles. If successfully integrated, it is expected to exceed Toyota’s 5.2 million vehicles.

Breakthroughs in Electric Vehicles and Software Technology: The two parties will accelerate the development of electric vehicle platforms and smart technologies, reduce redundant investment, and enhance competitiveness. For example, in 2023, Honda Motor announced an investment of billions of dollars to develop electric vehicle technology, while Nissan Motor is committed to enhancing its e-POWER hybrid technology. This cooperation will help share R&D resources and shorten product launch cycles.

Global Market Layout: Cooperation will strengthen the influence of the three companies in Asia, the United States, and European markets. Mitsubishi Motors’ advantages in the Southeast Asian market can provide the new group with stronger competitiveness. In addition, Honda Motor and Nissan Motor will integrate their North American manufacturing and sales networks to increase market penetration.

Challenges Faced by the Cooperation

Cultural and Management Integration: Honda Motor is centered on engineering technology, while Nissan Motor emphasizes marketing strategies. The cultural differences between the two companies are significant. How to balance management power and decision-making models will be key to integration.

Restructuring of Capital and Equity Structure: Currently, Honda Motor will lead the new company and hold a majority of board seats, which may cause concerns and opposition from Nissan shareholders.

Market and Product Overlap Issues: The two companies compete in the Chinese, American, and Japanese markets. How to reasonably allocate resources and avoid internal competition will test the wisdom of management.

Industry Impact and Outlook

This cooperation will have a profound impact on the global automotive industry. The structure of the Japanese automotive industry will be further concentrated. Toyota Motor has allied cooperation with Subaru Motor, Suzuki Motor, and Mazda Motor. After this merger, Honda Motor, Nissan Motor, and Mitsubishi Motor will form the second-largest camp, confronting the market pattern dominated by Toyota Motor.

Secondly, the cooperation will trigger a wave of restructuring among other automakers. Volkswagen and BMW in Europe have accelerated investments in electric vehicle technology, while General Motors and Hyundai Motor have strengthened cooperation to respond to market changes. It is expected that more cross-national cooperation and integration cases will emerge in the coming years.

According to Bloomberg, “By 2030, the global electric vehicle market will reach 40 million vehicles, with an average annual growth rate of more than 25%.” If the new company can quickly launch competitive electric vehicle products, it is expected to regain market share.

Win-Win Cooperation and Long-Term Challenges

The cooperation between Honda Motor, Nissan Motor, and Mitsubishi Motor is a necessary move to respond to market changes, with the potential for scale advantages, technology sharing, and market integration. It also means that the three companies need to overcome challenges such as management, culture, and capital restructuring to truly achieve a win-win situation.

In today’s increasingly fierce competition in the global automotive industry, this cooperation will become a test of how traditional manufacturers respond to technological changes and market reshaping. In the next few years, the success or failure of this joint venture will directly affect the pattern change of the Japanese and even the global automotive industry.