China is the biggest market for electric vehicles and repurposing batteries in the world.

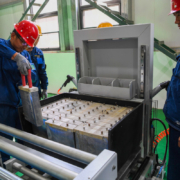

(Photo: China Daily)

- Electric vehicle industry technology is developing rapidly in China, and then they have a big number of repurposing batteries.

“According to Circular Energy Storage, Global battery-recycling capacity will surge nearly 10 times from 2021 to 2025, and is expected to surpass available scrap supply in 2022.”

The battery cost has always accounted for a large proportion of EV costs. Taking into account vehicle lifetime, battery life, and other factors, 25 GWh of battery decommissioning will be necessary for China by 2022. According to some research the battery recycling market in China reaching 3.48 billion USD by 2025, and currently, only around 30 – 40% of battery materials are recycled.

“McKinsey research calculated that the second-life battery supply for stationary applications alone could exceed 200 gigawatt-hours per year by 2030 by which time it will constitute a market with a global value north of $30 billion.”

The battery cost accounts for approximately 38 % of the total cost of an EV. When the battery capacity falls to 80 % of its original level, it can no longer be used continuously in the EV; however, these batteries are still valuable and can be used in battery energy storage systems.

Degraded lithium-ion batteries are available on the market for 44-180 $/kWh. With such low market prices, power station staff are more willing to choose degraded LiBs over new lithium-ion batteries.

The secondary use of these batteries can reduce the purchase cost of batteries. In addition, it can eliminate the battery energy storage manufacturing process, which extends the lifetime of EV batteries and saves resources. In addition, off-peak low-cost electricity can be used to mitigate grid pressure. The secondary use of these batteries may have the ability to become a general component of future battery life cycles and occupy a part of the energy storage system market.

- Recycling enterprises had already joined the traceability platform to track both the origin and owners of disposed batteries.

China is the world leader in electric vehicle fleet size, and one of the few countries in the world that is already concerned about the impacts caused by short- and long-term battery disposal.

“According to Jochen Goller, president, and CEO of BMW Group Region China said that increasing the use of recycled materials and reducing dependence on rare raw materials can help cut the cost of raw material procurement and maximize the ecological and economic benefits.”

The Chinese government is stepping up the development of relevant policies on reusing power batteries, and the frequency and content of recent relevant policies are getting faster. Experts say that these and other signs indicate that China will issue regulations and policies on the reusing and mandatory recycling of old vehicle batteries soon.

New regulation in China now holds EV makers responsible for the recovery of batteries, requiring them to set up recycling channels and service outlets where old batteries can be collected, stored, and transferred to recycling companies. Researchers point out that the demand for storage batteries will continue to further expand with the optimization of the energy structure and the upgrading of information infrastructure.

GEM, China’s largest recycling center for waste batteries, is working on battery pack regeneration and has developed its own second-use battery modules which can be used in various applications. Due to low labor costs compared to battery costs, battery cells are being repurposed for numerous consumer applications.

A large number of old batteries have been redistributed in telecommunication infrastructure to back up transmission stations. High-quality repurposed batteries are replacing lead-acid-based backup power systems.